Global Corridor #1

The trouble with IMEC, CK Hutchison's $22.8 billion ports sale, focus on the Nacala Corridor, a film on cargo theft, Uzbekistan and Georgia on the BRI and more...

Dear Readers - welcome to the inaugural newsletter of Global Corridor. The world is experiencing massive restructuring of its economy, territory and technologies through new global infrastructure projects. Many of the investments in new railways, data-centres, real estate developments, port expansions, special/extractive zones, highways, and more are proceeding through massive, transnational, multi-modal corridors. We are seeing the making of a new global geography at an unprecedented pace and scale. To try and understand what’s going on I will be providing a round up of some of the most interesting news, stories, data, opinion + academic work that can help us make better sense of this transforming world .

1. Global Infrastructure News Briefing:

A round up of some of the biggest news on global infrastructure projects hitting the worlds media in recent weeks:

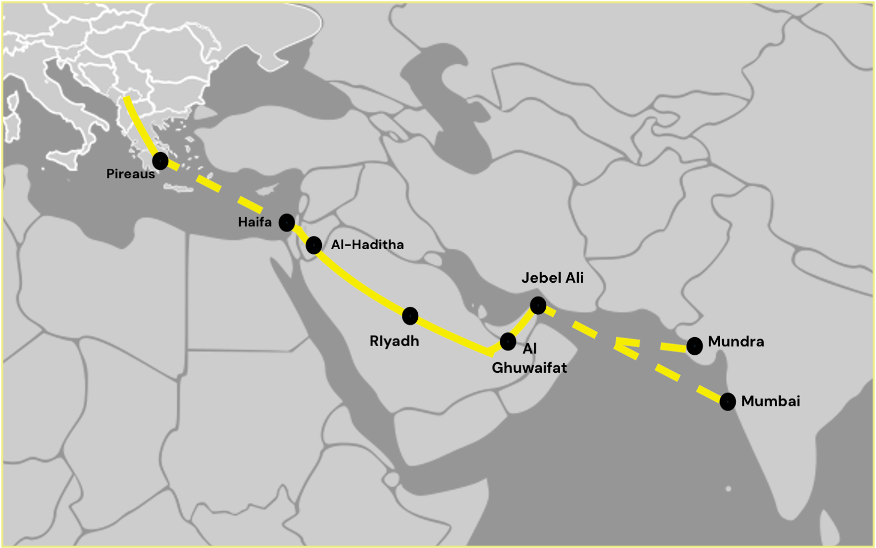

Trouble on the Indian Middle East Europe (IMEC) Corridor

The troubled 5000 km IMEC faces continued uncertainty given the central role of Israel in this initiative. Originally announced through a Memorandum of Understanding at the end of the 2023, G20 summit hosted by India, the White House suggested IMEC would, “usher in a new era of connectivity from Europe to Asia.” The purported aim is to integrate the logistical networks and economies of India, the UAE, Saudi Arabia, Jordan, Israel, and selected countries in Europe, accelerating logistical circulations between India and Europe by 40 percent, and cutting transportation costs by 30 percent. To construct IMEC will involve massive new investments in ocean and land based transport infrastructure to assemble rail and shipping routes, alongside a series of commitments for new digital and energy systems and new roles of cities along the route, with an as yet unspecified amounts of finance coming from the US, and Saudi Arabia pledging an initial $20 billion of funding.

IMEC was heralded at the G20 as accelerating and cementing US led diplomacy around ‘normalisation’ between Saudi Arabia/UAE and Israel that would cut Palestine out of the regional equation. But only weeks after the MoU came the events of October 7th and talks of normalisation between Israel and Saudi/UAE were paused, swiftly followed by the ocean based blockade by Ansar Allah, also known as the Houthis in Yemen, of Israeli shipping traffic grabbing the world’s attention and brought logistical bottlenecks and economic pressures. Now, the recent conflict between Iran and Israel has further pushed back attempts to make IMEC a reality, with the Geo-Political Monitor reporting the confrontation “not only threatens maritime and land-based supply chains amid Iran’s retaliation, but also emerging strategic partnerships—particularly the India–UAE segment of IMEC.”

The shifting geo-politics of CK Hutchison's $22.8 Billion Ports Sale

News is emerging of an interesting new development in the controversial deal by CK Hutchison to sell its portfolio of global ports after pressure from the White House for the US to reassert control over the Panama Canal. The Hong Kong listed conglomerate are now reportedly looking for a Chinese based investor to join the consortium of the world’s largest asset manager, US-based Blackstone and the world's largest container shipping company, the Mediterranean Shipping Company.

Image: Paul Harrison (CC-BY-SA-4.0)

Reports suggest that the state-run COSCO are being lined up as strategic partners and investors after CK Hutchison faced pressure from Beijing not to transfer 43 non Chinese ports such as Karachi, Barcelona and Felixstowe over to US aligned interests. The saga is likely to run on for many years given the red lines around the Panama Canal control by the Trump administration and the complicated international legalities and jurisdictional technicalities involved in the sale of these global infrastructure sites.

Mass summer mobilisation against the Turin-Lyon high-speed rail line (TAV)

In what has become an annual summer event in the Alps, thousands of activists descended on various construction sites in the Susa Valley connected to the high speed rail project connecting Turin and Lyon. Reports suggest the decades old, No-TAV movement damaged three sites while being met by severe repression from Italian police.

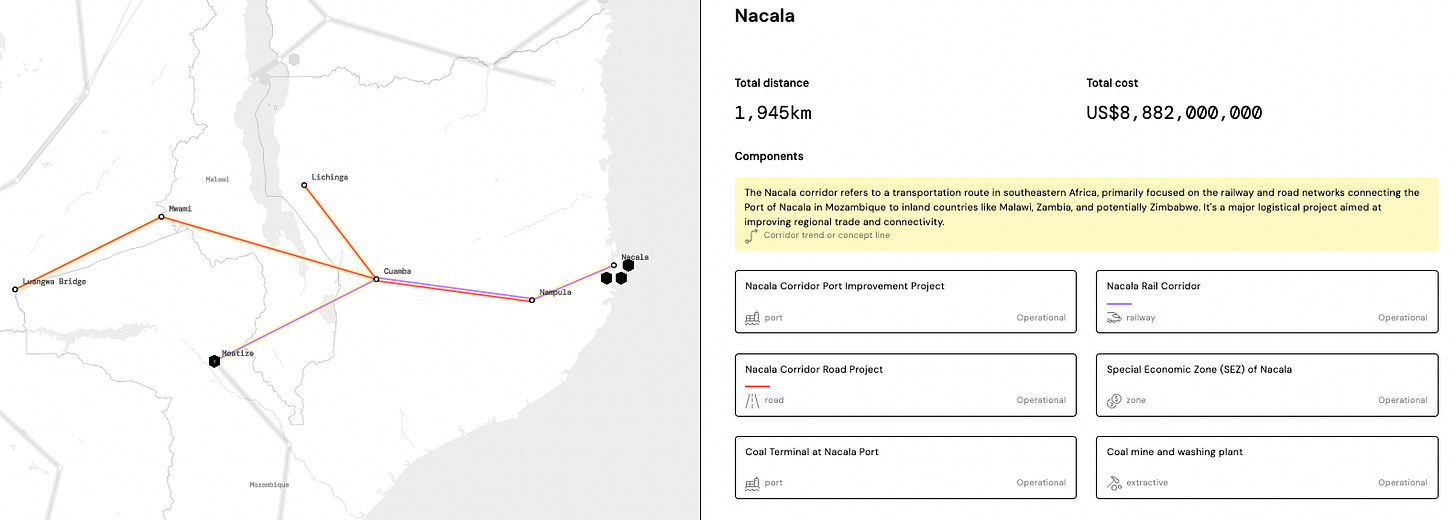

2. Featured Corridor: Nacala Corridor

Each newsletter features a more detailed focus on an infrastructure corridor, drawing on the developing Atlas being developed by the Global Corridor project (and due for release in early 2026).

The Nacala Corridor is governed by a collaborative effort between the governments of Mozambique, Malawi, and Zambia, with the Nacala Development Corridor (NDC) Management Committee overseeing operations. Additionally, the African Development Bank and other international financial institutions play a role in funding and supporting infrastructure development within the corridor.

However, the establishment of the corridor has primarily been driven by the massive extraction project based on 954 million tonnes of coal reserves at the Moatize coal mine and the need to get this natural resource into global markets. Originally developed by the Brazilian mining giant, Vale with operations beginning in 2015 the corridor (mine + railway + port + processing zones) was heralded as ‘Africa’s largest ever infrastructure financing project’. In this sense it prefigured some of the other massive deals concluded by mining giants in proceeding years (most notably the Simandou iron ore project in Guinea) as the race for Africa’s resources heated up. And yet by 2022 the mine and associated infrastructures were sold on to the Australian based Vulcan Resources for $270 million with Vale stating the sale was part of “its strategy of focusing on its core businesses and on its goal of becoming a leader in low-carbon mining.” This contrasted with the criticisms of the project from environmental NGO’s such as Friends of the Earth who documented forced resettlements, water pollution and repression among local populations.

Beyond the mining activities investments included the Nacala Corridor railway, a new and rehabilitated railway line that operates in northern Mozambique on a 912 kilometres (567 mi) line that runs west from the port city of Nacala, crossing the central region of Malawi, connecting with the coal belt of Moatize, in northwest Mozambique. It was financed by Vale, and constructed by Mota-Engil with the specific aim of transporting 18,000,000 tonnes coal per year.

Image: Matthias Hille (CC BY 4.0)

Another crucial investments in the Nacala Corridor has been a Port Improvement Project valued at around $350 million and with loan financing from the Japan International Cooperation Agency (JICA) and African Development Bank, as well as investment from Vale, with construction by Penta-Ocean Construction Company. The harbour at Nacala had been developed immediately after World War two to serve its own immediate hinterland as well as its neighbouring landlocked Malawi (then known as Nyasaland) in the west, which is served by a 900km railway – the longest in Mozambique. Cargo handled including many kind of extractive produce such as cotton, tea and tobacco and by the early 1970s the Port of Nacala was handling about 500,000 tons of cargo a year, making it Mozambique’s third most important port. The investments were completed in 2017 and have given the port the capacity to handle 10,000,000 tonnes cargo per year.

The driving objective behind the Nacala Corridor has very much been based on the economies of extraction and private investment and is in many ways quite different to the logistical/multi-modal objectives of other corridors in the region. Given the recent sale of the infrastructure assets at a hugely reduced price by Vale the next few years will offer some interesting perspectives on whether Nacala can find a broader (and non-extractive) logic.

3. Featured Image: ‘Down the Tracks’

New track being laid on the Northern Spur in Uganda that will rehabilitate the Tororo to Gulu line first built in the 1920’s as part of the colonial Uganda Railway and in recent years out of service. While the construction was initially to be funded by the European Union the financing deal fell through and the Government of Uganda took over the responsibility, contracting the China Road and Bridge Corporation (CRBC) to undertake the works demonstrating a new era in infrastructure investment in the country (Image take by J.Silver).

4. Global Infrastructure on Film

How U.S. Supply Chains Are Under Attack By Cargo Theft Criminals | Full Documentary by CNBC

5. New Academic Papers on Global Infrastructure

Featuring a selection of new academic papers covering various types of scholarship on global infrastructure:

Derisking failure: rethinking the promises of infrastructure-led development by Evelina Gambino & Lela Rekhviashvili in Mobilities

“Since the 2008 financial crisis an emerging regime of ‘infrastructure-led development’ places connectivity infrastructure at its centre. We begin this article with the proposition that many of the developmental promises associated with infrastructure have already failed, yet these failures rarely involve a rethinking of what underpins their promises. Drawing on ethnographic research on a failed project in the Republic of Georgia, the deep sea port of Anaklia, we suggest that an ethnographic engagement with failed infrastructure is necessary in order to tease out, and consequently challenge, the power geometries inherent in infrastructure-led development.”

A Mediterranean port-city in crisis: the case of Beirut by Nadine Hindi in City, Territory and Architecture

“The devastating explosion at Beirut port in August 2020, rated as the most powerful non-nuclear explosion of the twenty first century, not only destroyed the port but also significantly altered the city's identity and function as a port city. It destroyed the port infrastructure and has considerably limited its operational capacity. The aftermath context of the explosion has ignited an ongoing discussion on Beirut's identity as a port-city and serves as the point of departure for this article. Reflections on the future role of the port bring to light the implications of its urban history in relation to its geographic and political context. This article traces the rise of Beirut into a major port-city while highlighting the factors that caused its decline, revealing the complex systems that intertwined its growth to broader regional dynamics.”

Uzbekistan in the Belt and Road Initiative: Reviving Connectivity by Gökhan Tekir in Journal of Eurasian Studies

“This paper explores Uzbekistan’s strategic alignment with China’s Belt and Road Initiative (BRI) under President Mirziyoyev’s economic reforms, providing an in-depth analysis of policy documents and project assessments. The study highlights how BRI projects are transforming Uzbekistan’s landscape by significantly enhancing its connectivity and economic integration within Central Asia and beyond. A primary focus is placed on the substantial improvements in transportation infrastructure, such as the modernization of rail and road networks, which are critical for boosting trade and facilitating smoother logistics.”